Leveraging Section 179 Tax Benefits for Your Smart Fleet Technology Investments

As a forward-thinking business owner or fleet manager, investing in Smart Fleet Technology is crucial for optimizing fleet performance, ensuring safety, and streamlining operations. At skEYEwatch, we offer a comprehensive suite of solutions including skEYEvue truck camera systems, Dispatch360 concrete dispatch software, and skEYEtrax GPS fleet tracking, designed to revolutionize your fleet management experience. But did you know that the US tax code offers an opportunity to save money when investing in these technologies?

In this blog post, we’ll discuss how Section 179 of the US tax code can benefit companies that invest in Smart Fleet Technology solutions like ours, allowing you to enhance your fleet operations while enjoying significant tax savings.

Don’t forget to check our finance partners website for more info about Section 179: https://AscentiumCapital.com/Section179

Understanding Section 179

How Section 179 Benefits Your Investment in Smart Fleet Technology

By leveraging Section 179, you can significantly offset the cost of investing in skEYEwatch’s Smart Fleet Technology solutions. Here’s how it works:

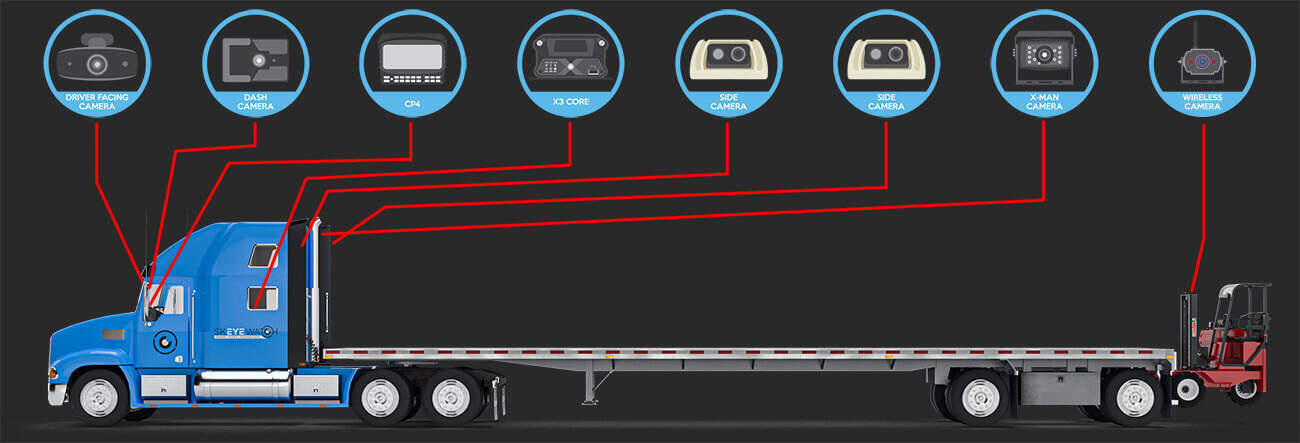

- skEYEvue Fleet Camera Systems: These advanced camera systems provide real-time monitoring and recording of your fleet’s activities, improving driver behavior and safety, reducing liability, and enhancing overall fleet efficiency. By claiming the full cost of these systems under Section 179, you can invest in better monitoring and safety without the burden of a hefty upfront expense.

- Dispatch360 Dispatch Software: Our Dispatch360 software streamlines your dispatching process, enabling better communication, route optimization, and real-time tracking. By deducting the cost of this software under Section 179, you can modernize your dispatching operations and enjoy a more efficient and cost-effective fleet management system.

- skEYEtrax GPS Tracking: Our skEYEtrax GPS tracking system offers real-time vehicle tracking, route optimization, and geofencing capabilities, enabling you to minimize fuel costs, improve driver performance, and increase productivity. With Section 179, you can deduct the full cost of this investment, making it even more financially viable to implement these crucial tracking features.

Maximizing Your Tax Savings with Section 179

To maximize your tax savings under Section 179, it’s essential to:

- Ensure your Smart Fleet Technology purchases qualify for the deduction. Check the IRS guidelines or consult with a tax professional to confirm eligibility.

- Keep accurate records of all qualifying purchases, including invoices and receipts, to provide the necessary documentation when filing your taxes.

- Invest in qualifying equipment and software before the end of the tax year (December 31) to claim the deduction in the current year.

Conclusion

Section 179 of the US tax code is a powerful incentive for businesses to invest in Smart Fleet Technology solutions like skEYEvue fleet camera systems, Dispatch360 dispatch software, and skEYEtrax GPS tracking. By leveraging this tax benefit, you can modernize your fleet operations, improve safety, and boost efficiency while enjoying significant tax savings. Consult with a tax professional to ensure you’re maximizing your Section 179 deductions and taking full advantage of this valuable opportunity.